Indexed Performance

RAK room revenue indexed to 2022

The Ras Al Khaimah market achieved an average occupancy of 71.2% and an ADR of AED 592.47 during 2024, equivalent to a 10.2% increase in RevPAR over the same period in 2023.

Key Performance Indicators (running 12 months 2024)

Real Estate X – Discovery Data, STR and HOTSTATS. Percentage change represents the change in running 12-month profit/cost per available room during the previous year i.e YTD TTM 2024 vs YTD TTM 2023

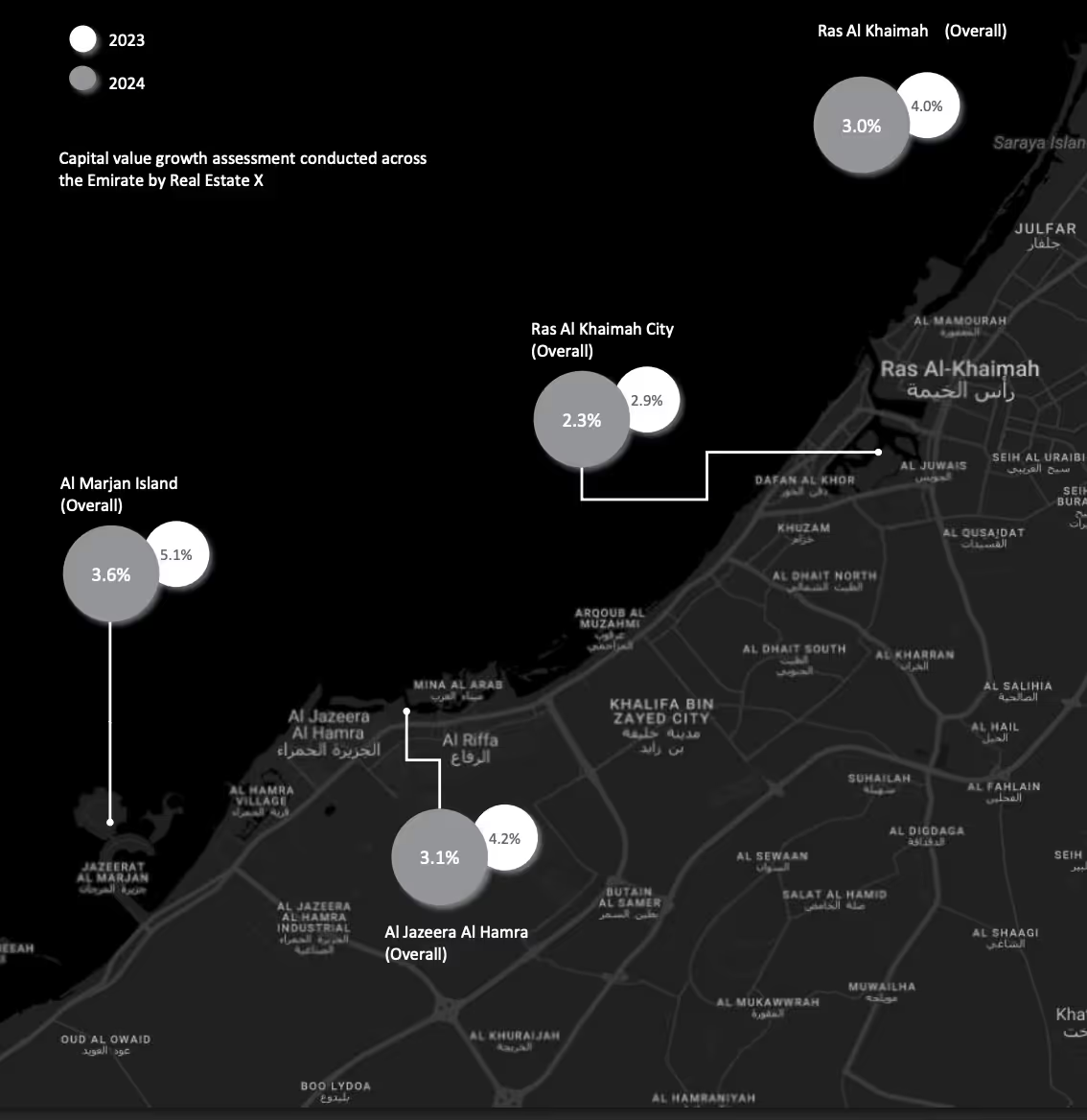

Values

Capital value growth assessment conducted across the Emirate by Real Estate X

Methodology

Capital value growth assessments are conducted across the Emirate using municipality statistics, STR, HOTSTATS and Real Estate X – Discovery data. This work is based on secondary market research and analysis of financial information available to Real Estate X at the time of the assessment. Real Estate X uses actual operating data to determine percentage changes in EBITDA, less FF&E from period to period with the assessment date being the first day of each subsequent period. Coupled with transactional evidence and forward-looking assumptions that reflect expectations of the market at the date of assessment, we assess any changes in perceived value.

Real Estate X gathers its data from sources it considers reliable; however, it does not guarantee the accuracy or completeness of the information provided. Any forward-looking information and statements contained herein are subject to various risks and uncertainties, many of which are difficult to predict and could cause actual performance to differ, other firms may also have differing opinions, projections or analysis. The information and analysis herein do not constitute advice of any kind and should not be used for investment purposes, Real Estate X, nor any of its subsidiaries or their respective officers, directors, shareholders, employees or agents accept any responsibility or liability with respect to the use of or reliance on any information or analysis contained in this document.

This work is copyright Real Estate X and may not be published, transmitted, broadcast, copied, reproduced or reprinted in whole or in part without the explicit written permission of Real Estate X and Real Estate X has no obligation to update or alter its opinions should market dynamics later change.

Explore Our Latest Insights

This blog explores the importance of surrounding yourself with like-minded individuals, mentors, and networks that can provide guidance, encouragement